Introduction to FirstKey Selling 48000 Homes

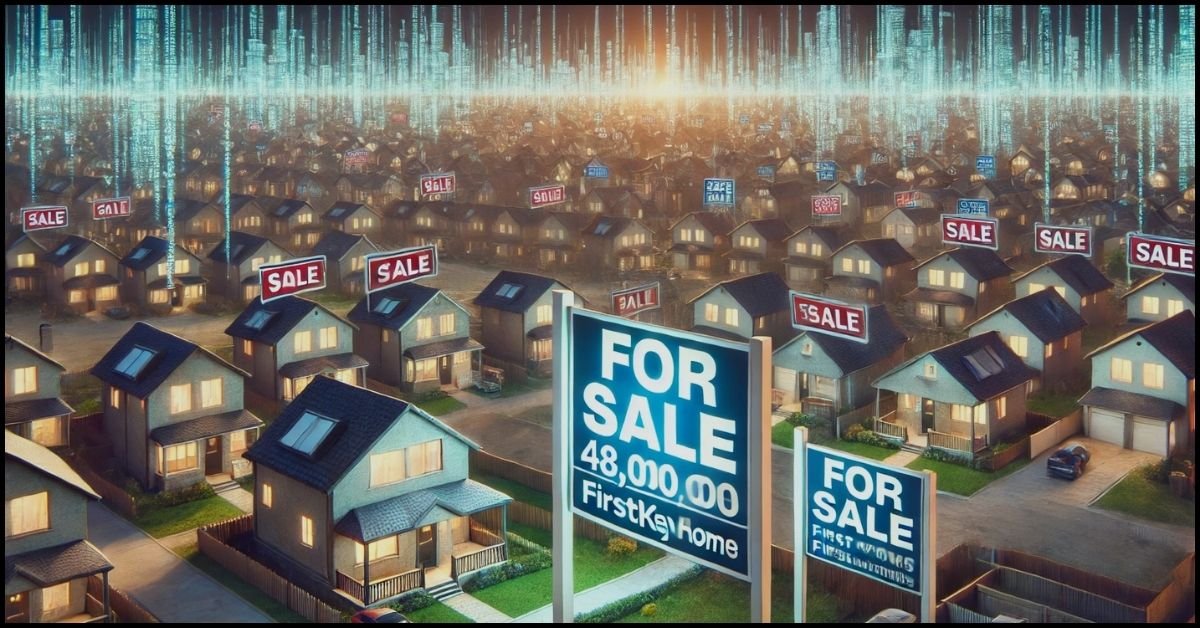

The real estate market is buzzing with the news that FirstKey Selling 48000 Homes, a major player in the rental housing sector, is preparing to sell 48,000 homes. As one of the largest providers of single-family rental properties in the United States, this decision could significantly impact buyers and investors. The sheer scale of the sale raises several questions about the reasons behind it, the potential market impact, and what it means for prospective homebuyers or real estate investors.

In this article, we’ll examine FirstKey Selling 48000 Homes, explore what might be driving this decision, and provide insight into how it could shape the future of the real estate market.

Why is FirstKey Selling 48000 Homes?

Shifting Business Strategy

FirstKey Homes has long been a leader in the single-family rental space. However, selling such a significant portion of their portfolio suggests a shift in business strategy. One possible reason could be a pivot toward a more streamlined or diversified portfolio. Companies often make such decisions to optimize operations, refocus on new opportunities, or free up capital for reinvestment.

The real estate landscape has been evolving rapidly, and FirstKey may be adapting to changes in demand or the rising cost of maintaining such a vast number of properties. By selling off 48,000 homes, the company may be positioning itself for future growth in different market segments or preparing for new investment strategies.

Economic Factors

Broader economic conditions could also influence the decision. Rising interest rates, inflation, and a cooling housing market may have prompted FirstKey to reassess the financial feasibility of holding onto such a large inventory. The U.S. housing market has seen fluctuations in recent years, with many real estate firms adjusting their strategies to mitigate risks associated with market downturns.

For companies like FirstKey, maintaining a large inventory of homes during uncertain economic times can be costly. Selling homes strategically allows them to capitalize on current market conditions while reducing the burden of property management and upkeep costs.

The Impact on the Housing Market

Increased Housing Supply

With 48,000 homes entering the market, the available properties will undoubtedly increase. In areas where FirstKey operates, this could lead to more options for potential homebuyers. Increased supply could also help stabilize home prices, particularly in regions where demand has consistently outpaced available inventory.

However, it’s important to note that not all homes may be sold at once. Depending on FirstKey’s approach, homes may be sold gradually or in bulk to institutional investors, which could impact the overall availability of these properties to individual buyers.

Effect on Rental Market

FirstKey’s decision to sell many rental homes could also impact the market. With fewer properties in their portfolio, the rental supply could tighten, leading to potential rent increases in some areas. However, if these homes are purchased by individuals rather than other large real estate investors, they may be removed from the rental market entirely, converting back to owner-occupied housing.

This shift could be significant for renters who have relied on FirstKey for affordable housing. It could also spur increased competition among other rental property management companies looking to fill the gap left by FirstKey’s exit from specific markets.

Opportunities for Homebuyers and Investors

Potential for First-Time Buyers

This influx of properties presents a unique opportunity for individuals looking to buy their first home. With so many homes being sold, FirstKey Selling 48000 Homes may be able to find properties at more competitive prices. If FirstKey offers incentives, such as lower down payments or flexible financing options, this could encourage more people to enter the housing market.

However, prospective buyers should remember that competition could still be fierce. If other investors or large-scale buyers are interested in the same properties, prices could increase in certain areas, particularly in regions with solid demand.

Investment Potential

The FirstKey Selling 48000 Homes represents a considerable opportunity for real estate investors. Investors looking to expand their portfolios can take advantage of the bulk sale of properties. This could be especially appealing for those interested in flipping homes, building rental portfolios, or entering new geographic markets where FirstKey properties are located.

It’s also worth noting that institutional investors may look to purchase large blocks of homes directly from FirstKey. These larger buyers are typically interested in long-term rental income and could outcompete smaller investors for entire sections of FirstKey’s portfolio.

How FirstKey Plans to Execute the Sale

Gradual Sales or Bulk Transactions

One important consideration is how FirstKey plans to sell these homes. If they opt for gradual sales over time, it could prevent an oversupply of homes in the market, which would otherwise drive prices down. This approach might benefit FirstKey financially, allowing them to maintain control over pricing and avoid flooding the market.

Alternatively, FirstKey could sell homes in bulk to institutional buyers, which might result in fewer individual buyers having access to the properties. Bulk sales are often faster and more efficient but could limit homeownership opportunities for families and first-time buyers.

Geographic Focus

FirstKey’s properties are spread across various regions in the United States, so the impact of the sale will vary by location. Areas where most homes are sold could experience noticeable changes in property values and rental availability. For buyers, this means researching the local market, which is essential to understanding the potential opportunities and challenges this large-scale sale poses.

FAQs about FirstKey Selling 48000 Homes

Why is FirstKey Selling 48000 Homes?

FirstKey is likely selling its properties as part of a strategic shift in its business model. The sale allows the company to refocus its portfolio, potentially reinvest in other areas, and respond to economic changes that affect the housing market.

How will the sale of 48,000 homes impact the housing market?

The sale will increase the housing supply, which could stabilize or lower home prices in some areas. It may also affect the rental market by reducing the number of available rental properties, potentially leading to higher rents in certain regions.

Will FirstKey sell all 48,000 homes at once?

It’s unclear if the homes will be sold gradually or in bulk. If they opt for gradual sales, it could prevent market saturation and allow for better pricing. Bulk sales to institutional investors could limit access to individual homebuyers.

What does this mean for first-time homebuyers?

An increased supply of homes may benefit first-time buyers, leading to more purchasing opportunities. However, competition from investors or other buyers could still increase prices in high-demand areas.

Is this a good opportunity for real estate investors?

Real estate investors can use this large sale to expand their portfolios. The availability of so many homes presents opportunities for both flipping properties and acquiring long-term rental investments.

What areas will be most affected by the sale?

FirstKey’s properties are spread across various regions, so the impact will vary depending on the location. Buyers and investors should research local markets to assess the availability of homes and potential changes in property values.

Conclusion

FirstKey Selling 48000 Homes by FirstKey marks a significant moment in the real estate market. This move could reshape the landscape in many regions for homebuyers, investors, and renters alike. Whether it leads to more significant opportunities for first-time buyers or increased competition among investors, the long-term effects of this sale will be closely watched by industry experts and consumers alike.

By monitoring how FirstKey proceeds with the sale and understanding the local market conditions, both buyers and investors can make informed decisions and potentially benefit from this major shift in the housing market.